Closed June 19th, 2025

We will be closed Thursday, June 19th, in observance of Juneteenth Day. Please utilize your digital channels for all of your banking needs.

Ripco takes the safety of your money and personal information very seriously. We have highly trained staff and multiple security safeguards and systems working on your behalf around the clock. You can rest assured that we are doing our part - but we need your help. Security is a team effort and we can't do it alone.

The following information will help you to understand what you can do to help us prevent unauthorized access to your money and how you can keep your information safe. We will update this page often in an effort to keep you up-to-date.

Beware of the latest online scams known as "Pig Butchering" scams, a name that aptly reflects the malicious intent behind these frauds.

Pig Butchering scams exploit various technology-based communication platforms, such as instant messaging, social media, and dating sites, to target unsuspecting victims. Scammers initiate contact under false pretenses, which could include posing as a wrong-number dialer or reconnecting with old acquaintances. These perpetrators often create an illusion of wealth through meticulously curated social media profiles, portraying themselves as investors or money managers. Their primary goal is to establish trust over time through consistent communication and ultimately lure victims into a seemingly lucrative investment opportunity involving virtual currency.

The scam involves promoting this investment opportunity through deceptive websites or applications that appear legitimate but are under the scammer's control. In some cases, the scammer may request remote access to the victim's devices to guide them through the virtual currency purchase process. Typically, victims are directed to transfer money overseas, purchase prepaid cards, or use virtual currency kiosks. However, the acquired virtual currency doesn't go where it's promised; instead, it's funneled into accounts controlled by the scammer. Victims, deceived by fictitious returns on their investments, may be coerced into selling their assets to invest more. As the victim's ability to invest dwindles, scammers resort to more aggressive tactics to extract final payments. Eventually, they vanish without a trace when the victim can no longer contribute, leaving them with their entire investment lost.

Protecting yourself against "Pig Butchering" scams and other online frauds requires vigilance and skepticism. Always verify the identity of individuals you interact with online, especially if they're offering investment opportunities. Be cautious when sharing personal information or granting remote access to your devices. Remember, staying informed and cautious is your best defense against falling victim to these malicious schemes.

Latest Text Scam We wanted to make you aware of an increase in texting-based fraud recently. Awareness after all, is always the first defense against potential scammers. The most recent text scam comes from what appears to be online.banking.activity.alerts or something similar, and the message looked like this (call 8777154760 Now! 390#) Your debit.card have been locked!

The examples we have been provided are filled with errors and bad grammar, but mistakes are easily overlooked when you simply skim a message like this. Take the time to closely review any message, but more importantly - do not call the number provided. As always, we recommend calling your local credit union branch when there is any question at all.

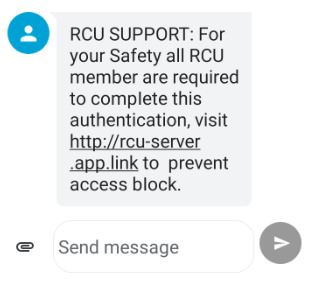

Another Text Scam to be on the lookout for is a text that looks something like this one from RCU SUPPORT. It looks like a genuine authentication text, except we AREN'T sending it and if you click on it, you may just find that you gave a scammer the opening they were looking for.

Another Text Scam to be on the lookout for is a text that looks something like this one from RCU SUPPORT. It looks like a genuine authentication text, except we AREN'T sending it and if you click on it, you may just find that you gave a scammer the opening they were looking for.

If you receive a text message from us that you didn't initiate, and weren't expecting - please question whether it is truly from the credit union. The last thing we want our members doing, is clicking on a link or responding to scammers who are only after your personal information.

We can't say this enough - when it doubt, please call the credit union to verify the authenticity of what you have received.

NEVER provide passwords, PIN numbers, account numbers, etc., over the phone, via text or email. Financial institutions will never ask for these numbers unless you have called us. If someone calls claiming to be a Ripco representative and asks for this information, be on high alert. One of the most common types of fraud includes criminals posing as representatives to "warn" you of a potential breach. They ask for this information under the guise of helping you when in reality they are trying to steal from you.

The most common sign that callers aren’t who they say they are is if they rush or pressure you to find and then hand over information. They might even get upset with you if you try to ask too many questions or aren't cooperating quickly enough. If you ever feel uncomfortable, politely hang up, and call the phone number on the back of your credit/debit card and verify whether the representative was indeed legitimate.

You can't depend on your caller I.D. Unfortunately one can't even believe the name showing up on the caller I.D. anymore. Fraudsters can easily display the name of your financial institution in an attempt to get you to lower your guard. If there is even the tiniest suspicion of fowl play, immediately hang up and call your bank or card holder directly.

Pay attention to a website’s URL. Malicious websites can often look identical to a legitimate site, but the URL will often use a variation in spelling or a different domain such as .net versus .com.

Microsoft Warning Alert scam. It is a full page, fake pop-up notification. A virus alert claiming that your computer is infected. This error is displayed by a malicious website that users visit inadvertently because you are being redirected by potentially unwanted programs that enter your system during the installation of regular apps.

The error message will tell you that malicious content has been detected and that your personal information (log-ins, passwords, banking information, etc.) are at risk. It will say that the malware must be eliminated immediately by contacting technicians via a telephone number provided by them.

Victims are then supposedly guided through the removal process - at a cost. Be aware, this error message is a scam! Criminals attempt to trick victims into calling and paying for services that are not required.

In order to prevent this situation, you must take two steps. The first - never rush when downloading and installing software. You can select the "Custom/Advanced" settings and this will allow you to analyze every step. Secondly, cancel all additionally-included applications and decline offers to download/install them. Caution is key to computer safety.

Amazon Scams. Ignore calls, text messages, emails and social media messages about suspicious account activity, raffles or unauthorized purchases. If you think you may have a real account problem, contact Amazon customer support at 888-280-4331.

Tax Impostors. Scammers are impersonating state, county and municipal law enforcement and tax collection agencies to get you to share sensitive personal information or send money to “settle your tax debt.” They may call, email or mail letters threatening to revoke your driver’s license or passport and often threaten to send the authorities to arrest you. Some even pretend to offer state tax relief.

Ignore any such calls and emails. Real tax agencies, from the IRS to your town tax collector, do business by mail and won’t ask you for passwords or bank account or credit card info. They also won’t threaten to call the police or ask you to pay with gift cards, payment apps or cryptocurrency.

Social Media. Be careful where you click. Fraud is prevalent on popular social networks like Facebook, Instagram and Twitter, and getting more so.

Facebook quizzes may seem like harmless fun, but the Better Business Bureau and digital-security companies warn that scammers sometimes use quizzes to gain personal data. Launching a quiz app may give its creators permission to pull information from your profile, offering hackers an opening to steal your online identity. How about the innocent-sounding queries about your high school mascot or first car? Fraudsters know these are common security questions that banks and financial firms use to protect accounts.

And then there’s the strangers who attempt to forge close bonds or romantic relationships on social media. Immediately cut off contact if they start asking for money.

It’s more important than ever to think carefully about what you post about yourself and your whereabouts. Hackers can use personal information for identity theft, and a seemingly innocent vacation photo can signal to criminals that your home is sitting empty.

We haven’t even begun to discuss shopping on social media. Beware of companies that will have you place an order, pay for it and then never send what you ordered. A legitimate seller will give you the details about the product, price and return/cancellation policies. Before ordering, check out the seller online, including reviews and complaints. If everything checks out, pay by credit card and keep a record of your transaction.

Don’t reveal personal or financial information in an email. This seems obvious, but Scammers use authentic looking fake emails or texts to lure you into sharing valuable personal information or to get you to follow a link within an email. This is called a phishing email and used to get access to your computer or network. If you click on a link within the email, they can install ransomware or programs that can lock you out of your data. They often use familiar company names like Google or Amazon or pretend to be someone you know.

Medicare. Never give your Medicare number to anyone who calls on the telephone. Share it only with your health care providers or if you have placed a call to Medicare. Medicare will not reach out to you regarding enrollment. If someone calls and makes a pitch to help you enroll in the program, that’s a scam.

Do your homework when it comes to donations. If someone wants a donation in cash, gift card, or by wiring money, don’t do it. When a major health event like the Coronavirus happens, people often look for ways to help, but Scammers use the same events to take advantage of your generosity. It pays to do some research before giving. Money lost to a bogus charity, is less money to help those truly in need. Research the organization you are considering, and never ever pay by gift card or wire transfer. When you give, pay safely by credit card.

Hang up on robocalls. Don’t press any numbers. Scammers may be using illegal robocalls to pitch everything from Coronavirus treatments to work-at-home schemes. You may be duped into pressing a number thinking it will remove you from their call list, when in fact it might lead to more robocalls.

Imposter calls. Someone may call claiming to be someone you know asking for money. They will often say it is an emergency, such as a medical emergency or that they need money because they are in jail. If this happens to you, verify the caller's identity. Ask them something personal; something only they would know. If still in doubt, ask for a call-back number and hang up. This will give you the opportunity to contact another relative or close friend to verify their story before calling them back.

Crypto currency. Although a newer form of currency, it is certainly gaining in popularity with the scammers. According to the Federal Trade Commission, “Nobody from the government, law enforcement, a utility company or prize promoter will ever tell you to pay them with cryptocurrency. If someone does, it’s a scam, every time.”

Staying safe online requires vigilance. Review your accounts and financial statements often. You should also review your credit report to look for incorrect information and unfamiliar accounts.

We hope you feel more aware and prepared to recognize the many ways that scammers and dishonest individuals are trying to get your money, personal information, account numbers, log-in IDs or passwords; but when in doubt, we are simply a phone call away. Call 715-365-4800 to report any suspicious activity.